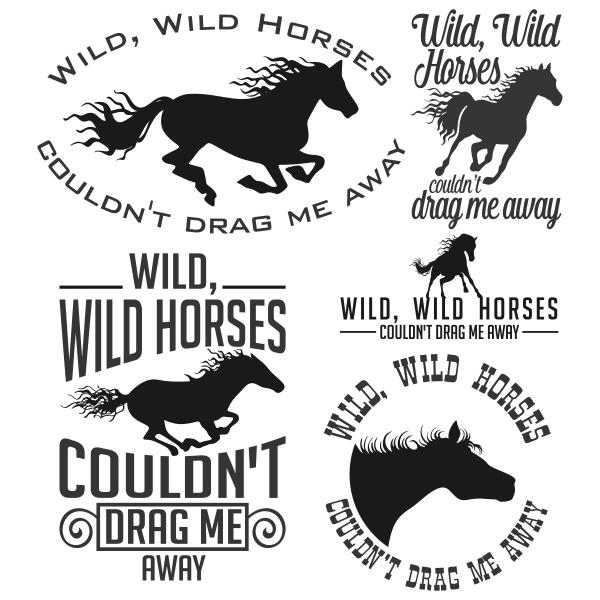

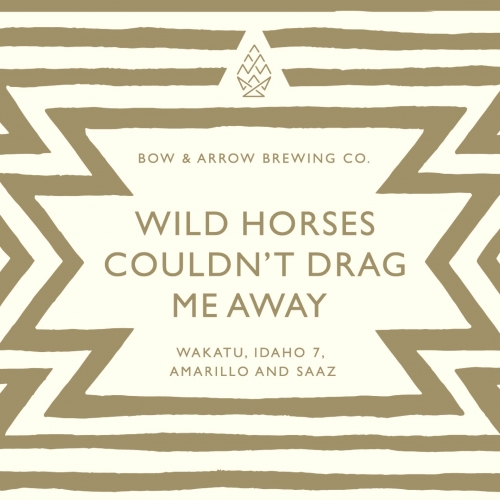

Wild horses, Couldn't drag me away Cuttable Designs | Apex Embroidery Designs, Monogram Fonts & Alphabets

Wild horses couldn't drag me away. Galloping horses, sunny day, blue sky, landscape Painting by Olga Koval | Saatchi Art

Wild horses, Couldn't drag me away Cuttable Designs | Apex Embroidery Designs, Monogram Fonts & Alphabets

Wild horses, Couldn't drag me away Cuttable Designs | Apex Embroidery Designs, Monogram Fonts & Alphabets

![Couldn't Drag Me Away...Chantecaille Wild Horses Palette [ So Lonely in Gorgeous ] Couldn't Drag Me Away...Chantecaille Wild Horses Palette [ So Lonely in Gorgeous ]](http://3.bp.blogspot.com/-4Tgxpks1T7o/UxlxM0xLfnI/AAAAAAAALKI/mvfHtBd1emU/s1600/chantecaille+wild+horses+palette.jpg)